July 26, 2012

As discussed here previously the Illinois General Assembly recently passed a sweeping overhaul of its Enterprise Zone Act. If signed by the Governor, the new law will change how the State grants and renews economic development areas and will require additional reporting to help determine the effectiveness of the tax benefits provided under the law.

Enterprise zones are areas designated by governments as economically depressed and in need of tax benefits to promote growth and create or retain jobs. The concept underlying enterprise zones is that reducing government regulation and taxation in economically depressed areas will stimulate local business enterprise and investment that would otherwise not occur. Currently, 43 states have created enterprise zone programs and there are well over 3,000 enterprise zones in the U.S. The administration and type of tax benefits allowed for in these zones varies greatly from state-to-state and even within different localities of each state.

The following excerpts are from the Civic Federation’s forthcoming report, Illinois Enterprise Zones: An Issue Brief. This chapter compares the number of zones in Illinois to other key states and describes the different tax benefits provided around the country.

ENTERPRISE ZONES IN SELECTED STATES

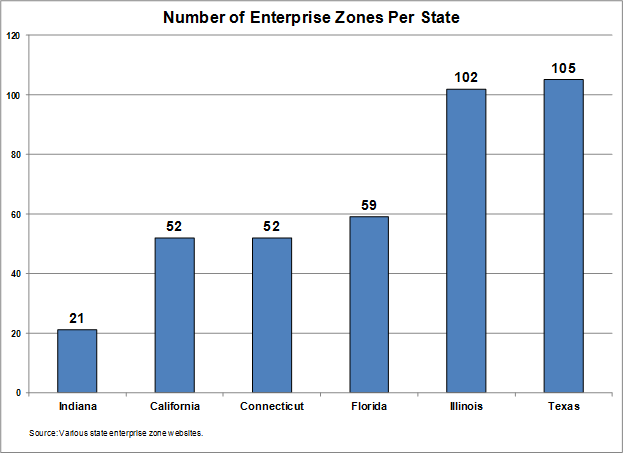

This section of the report compares the operation of enterprise zones in a representative sample of states: Indiana, California, Connecticut, Florida and Texas. The number of enterprise zone and related areas located in each of these states and Illinois is shown below. The Illinois figure will be operative in 2013, reflecting recent passage of legislation increasing the number of zones.

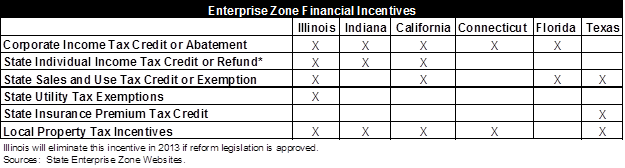

The states offer a wide variety of state and local enterprise zone incentives to qualifying businesses and individuals. These are summarized in the table below. Illinois offers the greatest types of incentive and is the only state to offer utility tax incentives.

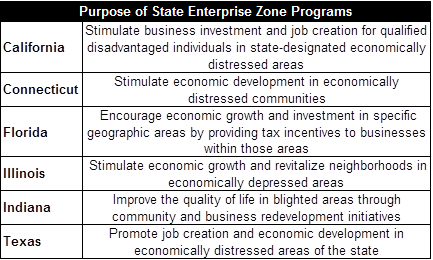

The stated purposes of enterprise zone programs in different states are shown below. All note that the intent of these programs is to remediate blight. However, they emphasize different ways to achieve that goal ranging from stimulating business development job creation to improving the quality of life.

Tax Incentives by State:

California

Enterprise zones: Individuals or businesses located in an enterprise zone may be eligible for the following program benefits:

- Hiring Credits - Firms can earn $37,440 or more in state income tax credits for each qualified employee hired;

- Up to 100% Net Operating Loss (NOL) carry-forward for state income tax liability. NOL may be carried forward for 15 years (it was suspended for tax years 2002 and 2003);

- Up-front expensing of certain depreciable property. Lenders to Zone businesses may receive a net interest income deduction on state income taxes;

- Corporations can claim a credit equal to the sales or use tax paid or incurred on the purchase of qualified property not to exceed $20 million. Individuals and partnerships can receive the credit for up to $1 million;

- Unused tax credits can be applied to future tax years, stretching out the benefit of the initial investment; and

- Enterprise Zone companies also can earn preference points on state contracts.

Local Agency Military Base Recovery Area (LAMBRAs): Businesses located in a LAMBRA Zone are eligible for program benefits. The tax incentives provided include:

- Up to 100% Net Operating Loss (NOL) carry-forward. The NOL may be carried forward 15 years. Firms can earn $31,544 or more in state tax credits for each qualified employee hired up to $2 million per year;

- Corporations can earn sales tax credits on purchases of $20 million per year of qualified machinery and machinery parts;

- Businesses are eligible for up-front expensing of certain depreciable property, up to $40,000 annually from state income taxes;

- Unused tax credits can be applied to future tax years, stretching out the benefit of the initial investment; and

- Communities also are eligible for local community incentives as a part of a business attraction package. The incentives may include the use of machinery, tools or office equipment left behind by the military.

Manufacturing Enhancement Areas (MEAs): Businesses in the MEAS are eligible for:

- Streamlined local regulatory controls;

- Reduced local permitting fees; and

- Up to $29,234 or more in state income tax credits for each qualified employee hired.

Targeted Tax Areas (TTA): Businesses in a TTA may be eligible for:

- Tax credits for sales and use taxes paid on certain machinery, machinery parts and equipment;

- Income Tax credits for hiring qualified employees; and

- A fifteen year net operating loss carry-forward.

Connecticut

Enterprise Zones: Qualified businesses in enterprise zones are eligible for several tax incentives:

- A five-year, 80% abatement of local property taxes on all qualifying real and personal properties that are new to the municipal tax rolls as a direct result of a business relocation, expansion or renovation project.

- A 10-year, 25% or 50% credit on that portion of the Connecticut Corporate Business Tax that is directly attributable to the business’s business relocation, expansion or renovation project as determined by the Connecticut Department of Revenue Services. Qualifying for the 50% credit requires that at least 30% of new employees are residents of the municipality and are eligible under the federal Workforce Investment Act.

- Exemption from the real estate conveyance tax.

Newly formed corporations located in a zone qualify for a 100% corporate tax credit for their first three taxable years and a 50% tax credit for the next seven taxable years. The corporation must have: (1) at least 375 employees, of which at least 40% are either zone residents or are residents of the municipality and who qualify for the Workforce Investment Act, or (2) less than 375 employees, at least 150 of which are zone residents or are residents of the municipality and who qualify for the Workforce Investment Act.

Any businesses engaged in biotechnology, pharmaceutical, or photonics research, development or production, with not more than three hundred employees, are eligible for Enterprise Zone benefits if they are located anywhere in a municipality with (1) a major research university with programs in biotechnology, pharmaceuticals or photonics and (2) an Enterprise Zone. Benefits are subject to the same conditions as those for businesses located in an Enterprise Zone.

Residential and commercial property owners are also eligible for fixed property assessments for improvements made during the time an area is designated as an enterprise zone. The fixed assessment is for a seven year period. The amount of deferral on increased assessments due to improvements is 100% in years one and two, 50% in year three, then declining 10% per year through year seven. These benefits are provided at the local level.

Urban Jobs Program: Benefits provided to participating businesses include:

- A five-year, 80% property tax abatement.

- A ten-year, 25% corporation business tax credit to qualified manufacturing businesses.

- A five-year, 80% property tax abatement for real estate and/or equipment for qualifying service facilities, provided on a sliding scale basis. The minimum investment is $20 million to qualify for a five-year, forty percent tax abatement. This benefit increases to an eighty percent, five-year tax abatement for projects with an investment greater than $90 million. The equipment qualifies only if it is installed in a facility that has been newly constructed, substantially renovated or expanded.

- A ten-year corporate business tax credit for or qualifying service facilities on a sliding scale basis based on new full-time jobs created. The minimum tax credit of 15% is allowed for service companies creating 300 or more but less than 599 new jobs. The benefit increases to 50% for such companies creating 2,000 or more new jobs at the eligible facility.

Florida

Jobs Tax Credit - Rural Enterprise Zones:Allows a business located within a Rural Enterprise Zone to take a sales and use tax credit for 30 or 45 percent of wages paid to new employees who live within a Rural County. To be eligible, a business must create at least one new job. The Sales Tax Credit cannot be used in conjunction with the Corporate Tax Jobs Credit.

Jobs Tax Credit - Urban Enterprise Zones:Allows a business located within an Urban Enterprise Zone to take a sales and use tax credit for 20 or 30 percent of wages paid to new employees who reside within an enterprise zone. To be eligible, a business must create at least one new job. The Sales Tax Credit cannot be used in conjunction with the Corporate Tax Jobs Credit.

Business Equipment Sales Tax Refund - Rural and Urban Enterprise Zones:A refund is available for sales taxes paid on the purchase of certain business property, which is used exclusively in an Enterprise Zone for at least 3 years.

Building Materials Sales Tax Refund - Rural and Urban Enterprise Zones:A refund is available for sales taxes paid on the purchase of building materials used to rehabilitate real property located in an Enterprise Zone.

Sales Tax Exemption for Electrical Energy - Rural and Urban Enterprise Zones: A 50% sales tax exemption is available to qualified businesses located within an Enterprise Zone on the purchase of electrical energy, if the municipality has reduced the municipal utility tax by at least 50%.

Property Tax Credit - Rural and Urban Enterprise Zones: New or expanded businesses located within an enterprise zone are allowed a credit against Florida corporate income tax equal to 96% of ad valorem taxes paid on the new or improved property.

Community Contribution Tax Credit Program - Rural and Urban Enterprise Zones: Allows businesses a 50% credit on Florida corporate income tax, insurance premium tax, or sales tax refund for donations made to local community development projects. Businesses are not required to be located in an enterprise zone to be eligible for this credit.

Property Tax Exemption for Childcare Facilities - Rural and Urban Enterprise Zones: Provides an exemption from ad valorem property tax for licensed childcare facilities operating in areas designated as enterprise zones.

Indiana:

All of the following tax benefits are provided in Indiana as parts of enterprise zones.

Employment Expense Credit: A state tax credit equal to 10% of the additional wages paid to qualified employees up to a maximum of $1,500. At least 90% of the employee’s services must be directly related to the enterprise zone business, and at least 50% of the employee’s time must be spent working at the enterprise zone business. Unused credits may be carried forward for up to 10 years or carried back for up to three years. The credit may be applied against individual or corporate adjusted gross income taxes, financial institutions tax or insurance premiums tax liabilities.

Investment Cost Credit: A state tax credit for equity investment in an enterprise zone business equal to a maximum of 30% of the price of the ownership interest purchased by the taxpayer. The credit is nonrefundable, but unused credits may be carried forward. Unused credits may not be carried back. This credit may be applied against individual or corporate adjusted gross income tax liability.

Loan Interest Credit: This is a state tax credit for interest income earned by a taxpayer from a loan that directly benefits an enterprise zone business, increases enterprise zone property values, or is used to rehabilitate, repair, or improve an enterprise zone residence. The credit is equal to 5% of the loan interest received during the year. The credit is nonrefundable, but unused credits may be carried forward. Unused credits may not be carried back. The credit may be applied against the individual or corporate adjusted gross income taxes, the financial institutions tax or the insurance premiums tax liabilities.

Employee Income Tax Deduction: Qualified employees in an enterprise zone may deduct half of the adjusted gross income tax liability earned during the year up to a maximum deduction of $7,500. This can result in a $255 reduction in state income tax liability for a qualified employee. A qualified employee is an individual who lives in an enterprise zone and is also employed within that zone. To qualify for the deduction at least 90% of the employee’s services must be directly related to the enterprise zone business and at least 50% of the employee’s time must be spent working at the enterprise zone business.

Property Tax Investment Deduction: This is a property tax deduction for the increased value of an enterprise zone business property due to real and personal property investment by the business. The added valuation may be deducted for up to 10 years. Qualified investment at an enterprise zone location includes the following: (1) purchase of a building, new manufacturing or production equipment; (2) costs associated with the repair, rehabilitation, or modernization of an existing building and related improvements; (3) onsite infrastructure improvements; (4) construction of a new building; and (5) costs associated with retooling existing machinery.

Texas

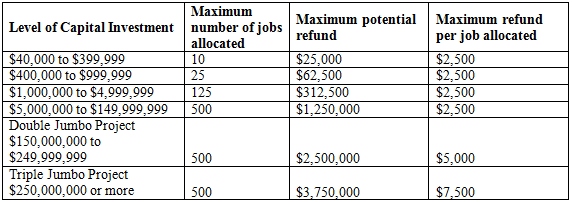

Approved enterprise projects are eligible to apply for state sales and use tax refunds on qualified expenditures. The level and amount of refund is related to the capital investment and jobs created at the site.

Each project is limited to a maximum refund of $250,000 per year for five years for a regular enterprise project designation, $500,000 per year for five years for a double jumbo enterprise project and $750,000 per year for five years for a triple jumbo enterprise project.